The insurance market is a puzzle of fluctuating costs, regulatory reforms, and ever-changing consumer behavior.

With a strong theoretical background, and vast experience in the insurance market, the Finalytix team will help you win the game.

Using trusted traditional practices, combined with latest developments in data science, we help insurers make better-informed decisions and design strategies that enhance their business results.

Better manage your portfolio by developing a solid, flexible, and smarter risk structure.

Improve your retention and profitability, Become more competitive by leveraging the power of behavioral pricing.

Merge your data with external resources, develop models to reduce your operational costs, and make better decisions across your organization.

We think out-of-the-box and take pride in finding creative solutions to complex business problems.

Powered by the most advanced technological tools, we apply critical thinking and challenge traditional practices.

We’re with you every step of the way, offering your team full guidance and support. From the initial scoping until the final outcome and beyond.

We base our business on fairness and transparency. We value our customer relationships above all and offer simple and straightforward pricing.

We’ll never offer you an off-the-shelf solution. Our projects are built in complete alignment with your goals and unique business framework.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

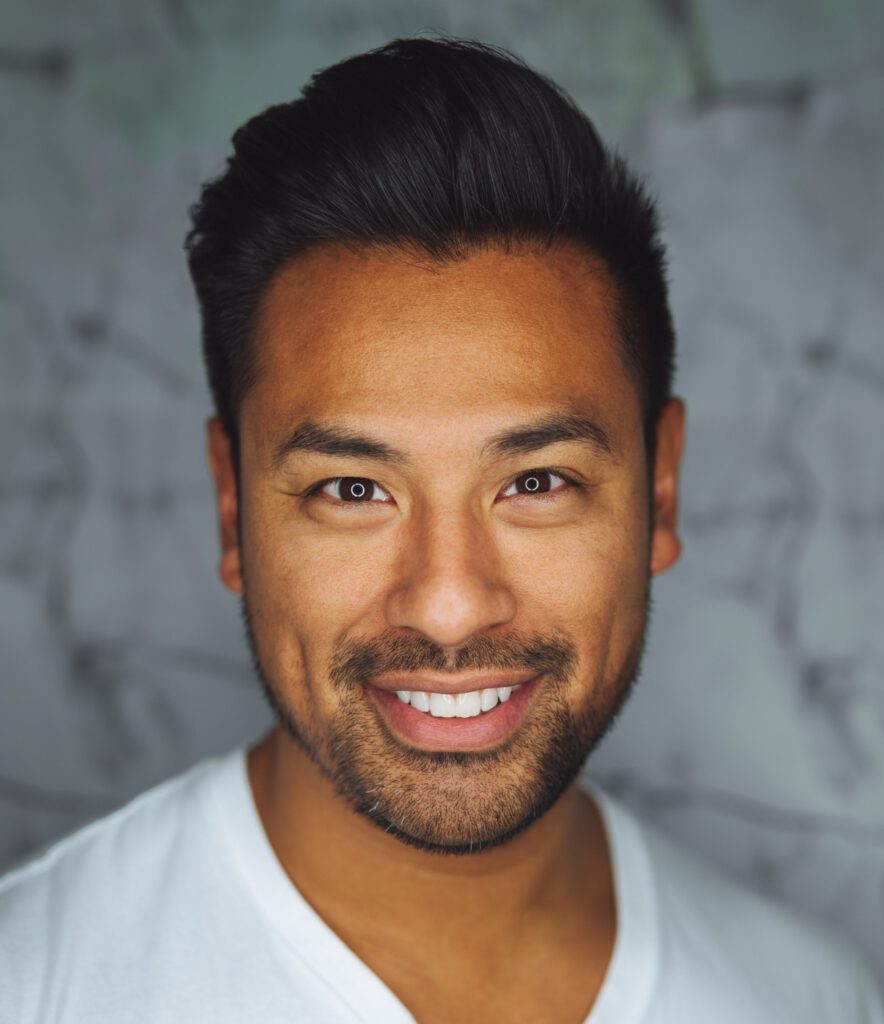

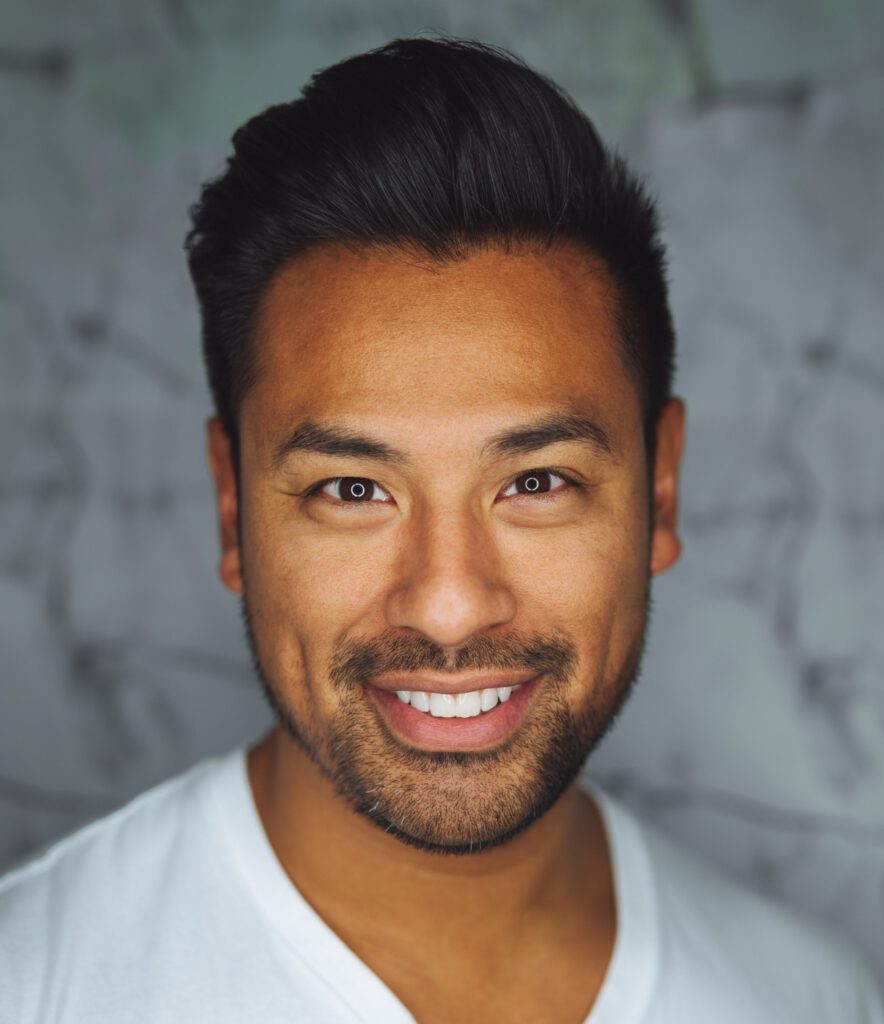

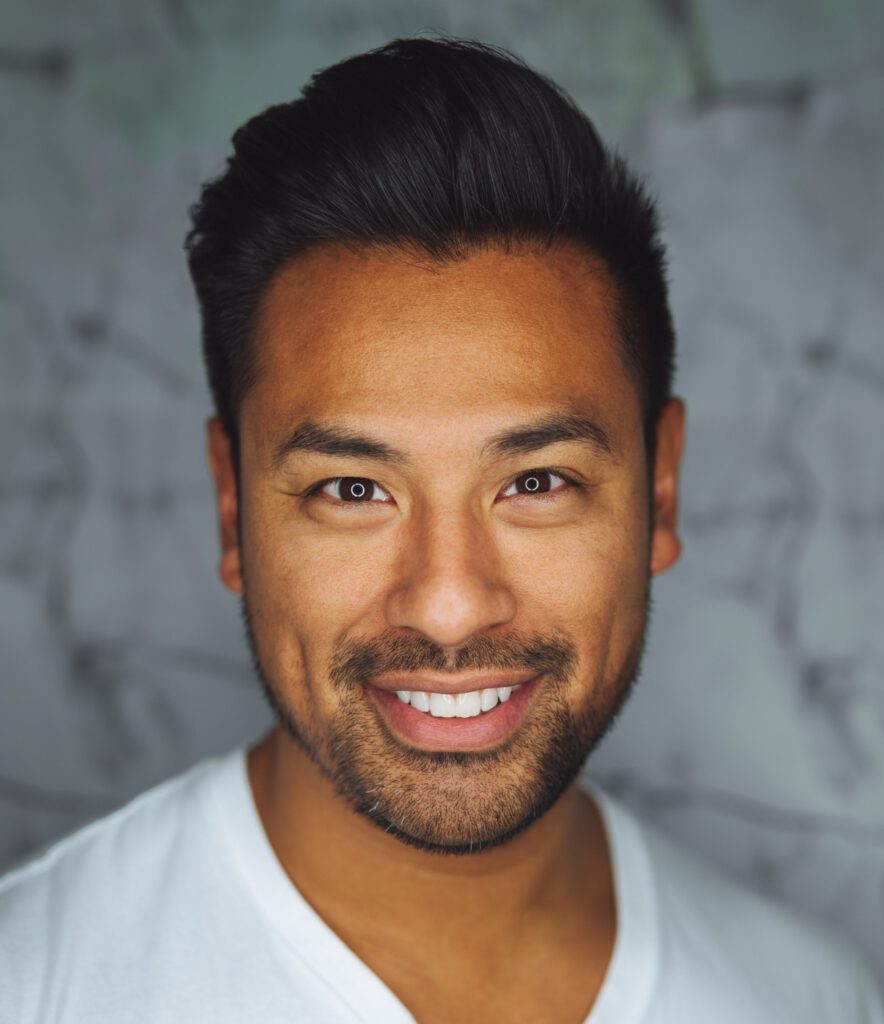

Like many data scientists, I’ve always believed in numbers. But I’ve also always believed in people, and in their power to use numbers and craft solutions to real-life problems.

I founded Finalytix with the goal of bringing the power and precision of data science into the insurance market, a market where precision is the name of the game. I’ve made it my mission to convert theoretical scientific principles into actionable practices that have the power to impact the business’s bottom line.

Together, we can apply data science to gain a clearer view of the market and act with precision.

Founder, Finalytix

Latest trends, tips, and insights for insurance professionals

Our team is available to answer any question and provide further information.

By using this website your agree to our cookie policy